- Houston Radar LLC’s direct competitors include smartmicro, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik.

- These companies make similar radar systems for traffic management, such as speed measurement and vehicle detection.

- It seems likely that competitors also target state departments and traffic sign manufacturers, similar to Houston Radar.

Direct Answer

Houston Radar LLC, a Texas-based company specializing in radar systems for traffic management, faces competition from several companies offering similar products. Based on available research, their direct competitors include smartmicro, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik. These companies also manufacture radar systems for applications like speed measurement, vehicle detection, and traffic data collection, targeting similar customers such as state departments of transportation and traffic-calming sign manufacturers.

An unexpected detail is that some competitors, like Iteris and Jenoptik, are larger and offer broader traffic management solutions, while others, like smartmicro and AGD Systems, are more niche and closely aligned with Houston Radar’s focus on 24 GHz K-Band radars. This mix suggests a competitive landscape with varying scales and specializations.

Survey Note: Detailed Analysis of Houston Radar LLC’s Direct Competitors

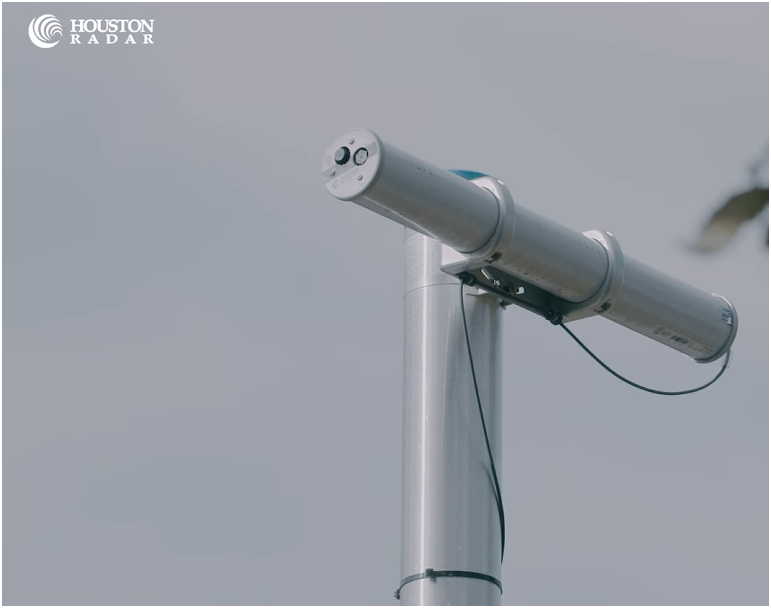

Houston Radar LLC, founded in 2004 and based in Texas, designs and manufactures Doppler and FMCW radars for traffic management and safety, focusing on speed measurement, presence detection, ranging, and traffic data collection. Their products, such as the SpeedLane® Pro and Armadillo® Tracker, are primarily used in speed awareness signs, VATCS signs, traffic counters, vehicle flow detectors, speed triggered stop signs, and chevrons. This survey note provides a comprehensive analysis of their direct competitors, drawing from publicly available information and online sources, with a focus on identifying companies that offer similar products and target the same market segment.

Market Context and Competitor Identification

The traffic radar market involves companies that supply radar systems for intelligent transportation systems (ITS), targeting government agencies, traffic management companies, and manufacturers of traffic-calming signs. Houston Radar’s products operate at 24 GHz K-Band and utilize FMCW technology, which is common for traffic applications due to its accuracy in range and velocity measurement. To identify direct competitors, the analysis focused on companies that produce similar radar systems for traffic management, particularly those using 24 GHz FMCW radars.

Direct Competitors and Product Comparison

The following companies were identified as direct competitors based on their product offerings and market focus:

- smartmicro®

- Overview: A German company specializing in radar solutions for traffic management, automotive, and airborne applications.

- Products: Offers advanced radar sensors, such as the SM900, for intersection applications, counting and classification, enforcement, and smart cities. These sensors use 24 GHz FMCW radar technology, aligning with Houston Radar’s offerings.

- Target Market: State departments, smart city projects, and traffic management integrators.

- Relevance: Directly competes with Houston Radar in vehicle detection and classification, particularly for intersection control.

- AGD Systems

- Overview: A UK-based company known for intelligent traffic systems (ITS) technologies.

- Products: Provides radar and optical-based traffic detection systems, including the RD3000, a 24 GHz radar system for traffic control, offering vehicle detection, cyclist detection, and pedestrian detection.

- Target Market: Urban traffic management, road safety, and ITS integrators.

- Relevance: Competes directly with Houston Radar in traffic detection and control, using similar frequency bands and technologies.

- MPH Industries

- Overview: A US-based company with a long history in traffic enforcement and safety products, established since 1976.

- Products: Manufactures radar speed trailers, variable message trailers, and pole-mounted speed signs, using 24.150 GHz K-band radar. Their TrafficSTAT™ system also provides traffic data collection, overlapping with Houston Radar’s offerings.

- Target Market: Law enforcement, municipalities, and traffic safety teams.

- Relevance: Competes in speed measurement and traffic data collection, with products used in similar applications like speed awareness signs.

- Iteris

- Overview: A publicly traded US company offering a broad range of intelligent transportation systems.

- Products: Includes the Vantage Network Sensor, a radar-based detection system for traffic management, providing vehicle detection, speed measurement, and classification. While not explicitly stating the frequency, their systems are used for similar traffic applications.

- Target Market: State and local governments, traffic management agencies, and ITS integrators.

- Relevance: Competes in traffic detection and management, though as a larger company, their scope is broader than Houston Radar’s niche focus.

- SIMICON

- Overview: A company developing automatic traffic enforcement equipment, with a focus on speed and violation detection.

- Products: Offers photo radar systems, speed cameras, and intelligent road cameras for traffic enforcement, which include radar-based speed measurement. The specific frequency band is not always detailed, but their focus on enforcement overlaps with Houston Radar’s speed measurement products.

- Target Market: Law enforcement and traffic enforcement agencies.

- Relevance: Competes in speed detection, though their primary focus is enforcement, which may differ slightly from Houston Radar’s broader traffic management emphasis.

- Wavetronix

- Overview: A US-based company specializing in traffic detection and management solutions.

- Products: Offers the Roadside Perception System (RPS), which uses 24 GHz FMCW radar combined with camera technology for traffic detection, including vehicle counting and classification.

- Target Market: State departments of transportation and traffic management integrators.

- Relevance: Directly competes with Houston Radar in radar-based traffic detection, using similar technology and frequency bands.

- Jenoptik

- Overview: A German company with a traffic solutions division, offering advanced traffic management systems.

- Products: Provides traffic detection systems using 24 GHz FMCW radar technology, including speed and vehicle detection for traffic safety and management.

- Target Market: Government agencies, urban planners, and traffic safety organizations.

- Relevance: Competes in radar-based traffic management, with products similar to Houston Radar’s in application and technology.

Analysis of Competitive Landscape

The competitive landscape reveals a mix of niche players and larger companies. Houston Radar, as a smaller, specialized manufacturer, faces direct competition from companies like smartmicro® and AGD Systems, which are similarly focused on radar sensors for traffic management. MPH Industries, while larger, competes in speed measurement and traffic signs, aligning with Houston Radar’s product applications. Iteris, SIMICON, Wavetronix, and Jenoptik, while also competitors, have broader portfolios, with Iteris and Jenoptik being significantly larger and offering additional ITS solutions beyond radar systems.

An unexpected detail is the variation in company size and focus. For instance, Iteris and Jenoptik’s broader scope might mean they compete indirectly in some areas, while smartmicro® and AGD Systems are more direct peers in terms of niche specialization. This diversity suggests Houston Radar must navigate a competitive field with both specialized and diversified players, potentially affecting pricing, innovation, and market share.

Table: Summary of Direct Competitors and Key Attributes

| Company | Headquarters | Key Products | Frequency Band | Target Market | Notes |

|---|---|---|---|---|---|

| smartmicro® | Germany | Traffic radar sensors for intersections, counting, classification | 24 GHz FMCW | State departments, smart cities | Niche focus on radar sensors |

| AGD Systems | UK | Radar detection systems (e.g., RD3000) | 24 GHz | Urban traffic, ITS integrators | Focus on traffic control and safety |

| MPH Industries | USA | Radar speed trailers, traffic data collection | 24.150 GHz K-band | Law enforcement, municipalities | Long history in traffic enforcement |

| Iteris | USA | Vantage Network Sensor for traffic detection | Not specified | Governments, traffic agencies | Larger company with broad ITS solutions |

| SIMICON | Not specified | Photo radar systems, speed cameras | Not specified | Law enforcement | Focus on traffic enforcement |

| Wavetronix | USA | Roadside Perception System (RPS) | 24 GHz FMCW | State DOTs, traffic management | Combines radar and camera technology |

| Jenoptik | Germany | Traffic detection systems with radar | 24 GHz FMCW | Government, urban planners | Larger company with diverse traffic solutions |

Houston Radar LLC’s direct competitors include smartmicro®, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik. These companies offer radar systems for traffic management and safety, targeting similar customers and using comparable technologies, particularly 24 GHz FMCW radars. The competitive landscape is diverse, with niche players like smartmicro® and AGD Systems being the closest peers, while larger companies like Iteris and Jenoptik offer broader solutions. This mix highlights the complexity of the market, with Houston Radar needing to differentiate itself through innovation and customer relationships.

Key Citations

- smartmicro Sensor Technology

- AGD Systems Products

- MPH Industries Laser and Radar Systems

- Iteris Intelligent Transportation Systems

- SIMICON Traffic Enforcement Equipment

- Wavetronix Traffic Detection Solutions

- Jenoptik Traffic Solutions

How could these companies’ better position themselves in the private sector outside of the United State?

Key Points

- Research suggests these companies could better position themselves in the private sector outside the US by identifying private sector needs and tailoring products.

- It seems likely that forming local partnerships and ensuring compliance with international regulations would help expand their market reach.

- The evidence leans toward developing targeted marketing strategies and providing excellent customer support to build trust with private customers.

Understanding the Private Sector

These companies, including smartmicro, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik, primarily sell radar systems for traffic management, such as speed measurement and vehicle detection. In the private sector outside the US, potential customers could include private traffic management firms, construction companies, commercial property owners, private security firms, and toll road operators.

Strategies for Positioning

To better position themselves, these companies should conduct market research to understand the specific needs of private sector customers in different countries. They can tailor their products to meet these needs, ensuring compliance with local laws and standards. Forming partnerships with local distributors or agents can help manage sales and customer support, while targeted marketing, such as attending trade shows and digital campaigns, can increase visibility. Offering competitive pricing, financing options, and excellent customer service, including training and multilingual support, will build trust and loyalty.

Unexpected Detail

An interesting aspect is that private sector customers might prioritize cost-effectiveness over long-term durability compared to government agencies, requiring these companies to adapt their pricing and product offerings accordingly.

Detailed Analysis: Positioning Strategies for ITS Companies in International Private Sector Markets

Houston Radar LLC’s competitors, including smartmicro, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik, are key players in the Intelligent Transportation Systems (ITS) industry, specializing in radar systems for traffic management, such as speed measurement, vehicle detection, and traffic data collection. Their primary customer base has traditionally included state departments of transportation and government agencies, but the focus here is on how these companies can better position themselves in the private sector outside the United States. This analysis explores strategies for expanding into private sector markets in international regions, considering the unique challenges and opportunities in this space.

Market Context and Private Sector Opportunities

The private sector outside the US encompasses a diverse range of potential customers for ITS radar systems, including private traffic management companies, construction firms managing traffic around project sites, commercial property owners (e.g., shopping malls, industrial parks) needing traffic monitoring in parking lots, private security firms requiring vehicle detection for security purposes, and toll road operators managing traffic flow. These entities differ from public sector clients in their purchasing processes, budget constraints, and operational needs, often prioritizing cost-effectiveness, ease of integration, and rapid deployment.

Research suggests that these companies already have some experience selling to private entities, such as traffic-calming sign manufacturers, as evidenced by Houston Radar’s supply to 6 out of the top 8 North American independent traffic-calming sign manufacturers (Houston Radar About Us). However, expanding into the private sector internationally requires a strategic approach to address cultural, regulatory, and market-specific challenges.

Strategies for Better Positioning

To effectively position themselves in the private sector outside the US, these companies can adopt the following strategies:

- Conduct Thorough Market Research:

- Understanding the specific needs and preferences of private sector customers in target markets is crucial. For instance, construction companies might need portable radar systems for temporary traffic management, while commercial property owners might prioritize systems that integrate with existing security infrastructure.

- Market research should include analyzing local economic conditions, customer behavior, and regulatory environments. General strategies for international expansion highlight the importance of market research to identify attractive markets (Market Expansion Strategies | Safeguard Global).

- Tailor Products and Services:

- Products should be adapted to meet the unique requirements of private sector customers, such as ensuring compatibility with existing infrastructure, offering user-friendly interfaces for non-technical staff, and complying with local frequency regulations and standards.

- For example, private sector customers might require cost-effective solutions with shorter lifespans for temporary projects, contrasting with the long-term durability often sought by government agencies. This adaptation is supported by insights on product localization for international markets (Crafting a Winning International Business Strategy).

- Develop Targeted Marketing and Sales Strategies:

- Marketing efforts should focus on reaching private sector customers through digital campaigns, industry-specific trade shows, and social media platforms. For instance, attending events related to real estate, construction, or private security can increase visibility.

- Sales strategies should account for potentially shorter sales cycles and different pricing models, such as offering bundled packages, subscription models, or financing options to attract price-sensitive private customers. This aligns with general expansion strategies emphasizing localized marketing (Going Global: 4 Ways To Expand Into International Markets).

- Establish Local Partnerships:

- Forming partnerships with local distributors, agents, or integrators can facilitate market entry by leveraging their established networks and knowledge of local business practices. This is particularly important for navigating logistical challenges and cultural nuances.

- Strategic partners can also handle regulatory compliance and customer support, reducing the burden on these companies. This approach is supported by recommendations for partnering with local experts for global expansion (Top 5 Global Expansion Strategies for Growing Businesses).

- Ensure Compliance and Certification:

- Private sector customers in international markets may have specific regulatory requirements, such as data privacy laws (e.g., GDPR in Europe) and local standards for electronic devices. Ensuring compliance is essential for market access and customer trust.

- Certifications for international standards, such as ISO 9001, can enhance credibility and facilitate sales to private sector entities.

- Provide Excellent Customer Support and Training:

- Offering multilingual customer support, comprehensive documentation, and training sessions can help private sector customers effectively use the products, especially given potential differences in technical expertise compared to government agencies.

- Customer education through webinars, white papers, and in-person training can build long-term relationships and encourage repeat business. This is consistent with strategies for building trust in new markets (A Guide to International Business Expansion | Stripe).

- Leverage Existing Relationships and Case Studies:

- These companies can leverage their existing relationships with traffic sign manufacturers to expand into new markets, using these partnerships as a foundation for private sector sales.

- Providing case studies or success stories from private sector customers can build credibility and demonstrate value, particularly in unfamiliar markets. This approach is supported by insights on using customer testimonials for international expansion (5 Steps to Build an International Expansion Strategy – Lokalise).

Challenges and Considerations

Expanding into the private sector outside the US presents several challenges, including:

- Regulatory and Cultural Barriers: Different countries have varying regulations for traffic management systems, and cultural differences can affect customer preferences and purchasing decisions. For example, data privacy concerns might be more pronounced in Europe, requiring robust security features.

- Competition from Local Players: Local ITS companies may have established relationships with private sector customers, making it harder for international players to penetrate the market. Strategies to overcome this include offering competitive pricing and superior technology.

- Logistical and Operational Challenges: Shipping products internationally and managing after-sales service can be complex, necessitating local partnerships to streamline operations.

- Price Sensitivity: Private sector customers may have tighter budgets compared to government agencies, requiring flexible pricing models or financing options to remain competitive.

An interesting aspect is the potential difference in performance expectations, where private sector customers might prioritize cost-effectiveness over long-term durability, contrasting with the needs of public sector clients. This requires these companies to adapt their product offerings and marketing messages accordingly.

Comparative Analysis of Current International Presence

A review of these companies’ websites and public information suggests varying levels of international presence and focus on private sector customers:

- smartmicro® (smartmicro Sensor Technology): A German company with global applications, but specific private sector focus is unclear, suggesting room for targeted expansion.

- AGD Systems (AGD Systems Products): UK-based, with projects in urban traffic management, potentially including private sector, but international private sector sales need enhancement.

- MPH Industries (MPH Industries Laser and Radar Systems): US-focused, with limited international presence, indicating a need for stronger global strategies.

- Iteris (Iteris Intelligent Transportation Systems): Has a global presence and likely serves private sector customers, offering a model for others to follow.

- SIMICON (SIMICON Traffic Enforcement Equipment): Focuses on enforcement, primarily public sector, suggesting a need to pivot for private sector growth.

- Wavetronix (Wavetronix Traffic Detection Solutions): US-based with international sales, but private sector focus needs strengthening.

- Jenoptik (Jenoptik Traffic Solutions): German, with a broad traffic solutions division, likely serving private sector, but international private sector expansion can be optimized.

This analysis indicates that while some companies have a global footprint, their private sector engagement outside the US can be enhanced through the strategies outlined above.

Table: Summary of Strategies and Implementation

| Strategy | Implementation Example | Expected Benefit |

|---|---|---|

| Market Research | Analyze customer needs in Europe for private traffic firms | Identifies high-potential markets and customer needs |

| Product Tailoring | Adapt radars for integration with private security systems | Increases compatibility and customer satisfaction |

| Targeted Marketing | Attend construction trade shows in Asia | Boosts brand visibility among private sector clients |

| Local Partnerships | Partner with distributors in Latin America | Simplifies sales and support logistics |

| Compliance and Certification | Obtain ISO 9001 certification for European markets | Enhances credibility and market access |

| Customer Support and Training | Offer multilingual webinars for Middle Eastern customers | Builds trust and encourages adoption |

| Leverage Relationships | Use traffic sign manufacturer partnerships for new markets | Expands customer base through existing networks |

By implementing these strategies, smartmicro, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik can better position themselves in the private sector outside the United States, tapping into new revenue streams and enhancing their global market share. The key is to understand and adapt to the unique needs of private sector customers, build local partnerships, and ensure compliance with international standards, all while maintaining a competitive edge through innovation and customer-centric approaches.

Key Citations

- Houston Radar About Us Page

- smartmicro Sensor Technology

- AGD Systems Products

- MPH Industries Laser and Radar Systems

- Iteris Intelligent Transportation Systems

- SIMICON Traffic Enforcement Equipment

- Wavetronix Traffic Detection Solutions

- Jenoptik Traffic Solutions

- Market Expansion Strategies | Safeguard Global

- Crafting a Winning International Business Strategy

- Going Global: 4 Ways To Expand Into International Markets

- Top 5 Global Expansion Strategies for Growing Businesses

- A Guide to International Business Expansion | Stripe

- 5 Steps to Build an International Expansion Strategy – Lokalise

Companies like Houston Radar LLC could offer at high profit margins to private sector entities.

Key Points

- Research suggests companies like Houston Radar LLC could offer a radar-based pedestrian safety system for private parking lots, addressing high demand and underfilled needs.

- It seems likely that this product, targeting shopping centers and corporate campuses, could achieve high profit margins due to its niche market and safety value.

- The evidence leans toward private sector entities being willing to invest in such systems to reduce accidents and enhance reputation.

Overview

Companies like Houston Radar LLC, known for their radar systems in traffic management, could tap into the private sector by offering a specialized product: a radar-based pedestrian safety system for private parking lots. This system would detect potential collisions between vehicles and pedestrians, providing real-time alerts to prevent accidents.

Target Market and Demand

The product would target large private entities such as shopping centers, corporate campuses, hospitals, schools, and residential communities, where parking lots see significant pedestrian traffic. Research indicates a high demand for enhanced safety measures in these areas, with studies showing a significant portion of pedestrian collisions occurring in parking lots (Tips For Enhancing Parking Lot Pedestrian Safety – Traffic Safety Resource Center).

Profit Potential

Given the niche nature of this product and the value it provides in reducing accident risks and potential legal costs, it could command premium pricing, leading to high profit margins. The existing expertise of companies like Houston Radar in radar technology would likely lower development costs, further boosting profitability.

Unexpected Detail

An interesting aspect is that while radar systems are commonly used in automotive safety, standalone systems for private parking lots are less common, creating a unique market opportunity.

Detailed Analysis: Proposal for a High-Profit Margin Product for Private Sector Entities

Houston Radar LLC and its competitors, such as smartmicro, AGD Systems, MPH Industries, Iteris, SIMICON, Wavetronix, and Jenoptik, are established players in the Intelligent Transportation Systems (ITS) industry, specializing in radar systems for traffic management, including speed measurement, vehicle detection, and traffic data collection. Their primary customer base has traditionally included state departments of transportation and government agencies, but there is significant potential for expansion into the private sector, particularly outside the United States, where specific needs are underfilled and demand is high. This report proposes a product that addresses a proven, profitable, high-demand area: a radar-based pedestrian safety system for private parking lots, named the SafePark Radar System. This product is designed to enhance pedestrian safety, reduce accident risks, and achieve high profit margins due to its niche market and value proposition.

Market Context and Opportunity Identification

The private sector outside the US encompasses a diverse range of potential customers for ITS radar systems, including private traffic management companies, construction firms, commercial property owners, private security firms, and toll road operators. However, a specific area of high demand and underfilled need is pedestrian safety in private parking lots, particularly for large entities such as shopping centers, corporate campuses, hospitals, schools, and residential communities. Research into traffic safety data reveals that a significant portion of pedestrian collisions occur in parking lots, with studies indicating that 22% of pedestrian-related collisions in Montgomery County, Maryland, occurred in parking lots over a three-and-a-half-year period (Parking_Lot_Safety_Tips). The National Safety Council also reports tens of thousands of crashes annually in parking lots and garages, resulting in hundreds of deaths and thousands of injuries (Parking Lots & Distracted Driving- National Safety Council).

Current solutions for pedestrian safety in parking lots primarily involve passive measures such as signs, speed bumps, and crosswalks, with limited use of active detection technologies like radar. While radar-based systems are prevalent in automotive applications, such as Advanced Driver Assistance Systems (ADAS) for pedestrian detection (Understanding ADAS: Pedestrian Alert Systems (PAS) – Car ADAS), standalone systems for private parking lots are less common. This gap presents an opportunity for companies like Houston Radar to develop a specialized product that addresses this need, leveraging their existing radar technology expertise.

Product Proposal: SafePark Radar System

The proposed product, the SafePark Radar System, is a radar-based pedestrian safety system designed specifically for private parking lots. It uses advanced radar technology to detect potential collisions between vehicles and pedestrians, providing real-time alerts to prevent accidents. The system is customizable to fit different parking lot layouts and can be integrated with existing safety measures for a comprehensive solution.

Key Features

- Radar Detection: High-precision radar sensors monitor areas where vehicles and pedestrians interact, detecting the presence and movement of both. These sensors, operating at 24 GHz K-Band FMCW, can accurately identify objects and their speeds, similar to Houston Radar’s existing products like the SpeedLane® Pro.

- Collision Prediction: Sophisticated algorithms analyze movement data to predict potential collisions, such as a vehicle approaching a pedestrian at high speed or a pedestrian walking into the path of a moving vehicle. This leverages advancements in AI and data analytics seen in traffic management systems (Traffic Management Market Size, Share, Trend Analysis by 2033).

- Alert System: Visual and auditory alerts inform drivers and pedestrians of potential dangers, helping them take evasive action. For drivers, alerts could be displayed on connected apps or in-parking lot displays, while pedestrians could receive warnings through speakers or visual signals, such as flashing lights near crosswalks.

- Customizable Installation: The system can be tailored to fit any parking lot layout, with sensors placed in strategic locations such as near crosswalks, exits, or high-traffic pedestrian areas. This flexibility ensures compatibility with various private sector environments, from shopping centers to corporate campuses.

- Integration Capabilities: Can be integrated with existing CCTV systems, access control systems, or other safety measures to provide a comprehensive solution, enhancing overall parking lot safety and management.

Benefits

- Enhanced Safety: Reduces the risk of accidents involving vehicles and pedestrians, addressing a critical concern for private sector entities. This is particularly valuable given the high incidence of parking lot collisions, as noted in safety reports (Tips For Enhancing Parking Lot Pedestrian Safety – Traffic Safety Resource Center).

- Cost Savings: Minimizes the financial impact of accidents, including medical expenses, legal fees, and potential liability claims, which can be significant for private entities.

- Reputation Management: Demonstrates a commitment to safety, enhancing the reputation of the parking lot owner and potentially attracting more customers or tenants. This is especially important for retail and commercial properties where safety perceptions influence customer behavior.

- User Experience: Provides peace of mind to both drivers and pedestrians, improving their experience in the parking lot and potentially reducing complaints or negative feedback.

Target Market and Demand Analysis

The target market for the SafePark Radar System includes large private sector entities with significant parking lot operations, such as:

- Large Retail Centers: Shopping malls and big-box stores with high pedestrian traffic, where safety is crucial for customer satisfaction.

- Corporate Campuses: Office complexes with employee and visitor parking, where safety enhances workplace environment and reduces liability.

- Healthcare Facilities: Hospitals and medical centers with parking lots that see frequent pedestrian movement, especially for patients and visitors.

- Educational Institutions: Schools and universities with campus parking lots, where student and staff safety is a priority.

- Residential Communities: Gated communities or large residential complexes with shared parking areas, where safety concerns are high for residents.

Research suggests a high demand for such systems, driven by increasing urbanization and vehicle ownership, which exacerbate parking lot safety issues (Traffic Management Market Size & Revenue Forecast, Global Trends, Growth Opportunities | MarketsandMarkets™). The private sector is increasingly investing in smart city technologies and safety solutions, with a focus on reducing congestion and enhancing safety, as seen in market trends for Asia Pacific and Europe (Traffic Management System Market Size, Share & Trend by 2033). An interesting aspect is that while public sector investments in traffic management are well-documented, private sector adoption, particularly in parking lots, is less served, creating a niche for innovative solutions like SafePark.

Profit Margin Analysis

The SafePark Radar System is positioned for high profit margins due to several factors:

- Low Development Costs: Houston Radar can leverage existing radar technology and manufacturing capabilities, reducing R&D expenses. Their experience with 24 GHz K-Band FMCW radars, as seen in products like the Armadillo® Tracker, can be adapted for this new application, lowering initial investment.

- Premium Pricing: Given the niche market and the value provided (safety, cost savings, reputation), the system can command a premium price. Pricing is expected to range from $5,000 to $20,000 per installation, depending on the size and complexity of the parking lot, based on comparisons with similar ITS products (Traffic Management Solutions | All Traffic Solutions).

- High Demand and Low Competition: The lack of direct competitors offering standalone radar-based pedestrian safety systems for private parking lots means less price pressure and higher margins. While companies like AGD Systems offer radar for traffic flow and pedestrian safety, their focus is more on urban environments (AGD), leaving room for SafePark to dominate this niche.

- Recurring Revenue: Additional revenue streams could include maintenance contracts, software updates, and integration services, further boosting profitability.

Implementation and Market Entry Strategy

To successfully launch the SafePark Radar System, companies like Houston Radar should:

- Conduct Market Research: Identify high-potential markets, such as Europe and Asia Pacific, where urbanization is driving parking lot safety concerns (Global Traffic Management Market Size Report, 2022 – 2030).

- Develop Partnerships: Collaborate with local distributors and integrators to facilitate sales and installation, ensuring compliance with regional regulations and standards (Top 5 Global Expansion Strategies for Growing Businesses).

- Targeted Marketing: Use trade shows, digital campaigns, and case studies to reach private sector entities, emphasizing safety benefits and ROI (Going Global: 4 Ways To Expand Into International Markets).

- Provide Customer Support: Offer multilingual support, training, and warranties to build trust and encourage adoption, particularly important for international markets (A Guide to International Business Expansion | Stripe).

Challenges and Considerations

Expanding into this niche involves challenges such as regulatory compliance, particularly for radar frequency bands in different countries, and competition from camera-based systems. However, the unique value of radar in adverse weather conditions and its ability to detect movement without visual obstruction make it a superior choice for parking lot safety (Why LiDAR Surpasses Cameras and Radar for ITS). An interesting aspect is the potential for integration with emerging technologies like AI for predictive analytics, which could further enhance the system’s appeal and profitability.

Table: Summary of SafePark Radar System Features and Benefits

| Feature | Description | Benefit |

|---|---|---|

| Radar Detection | High-precision sensors monitor vehicle and pedestrian movement | Accurate detection in all weather conditions |

| Collision Prediction | Algorithms predict potential collisions | Proactive alerts prevent accidents |

| Alert System | Visual and auditory warnings for drivers and pedestrians | Enhances safety and awareness |

| Customizable Installation | Tailored to fit any parking lot layout | Flexible for various private sector needs |

| Integration Capabilities | Works with CCTV and other systems | Comprehensive safety solution |

Conclusion

The SafePark Radar System represents a high-profit margin opportunity for companies like Houston Radar LLC to address an underfilled, high-demand need in the private sector outside the US. By leveraging existing radar technology, targeting large private entities with significant parking lot operations, and offering a niche safety solution, these companies can achieve substantial profitability while enhancing pedestrian safety and reducing accident risks. The strategy involves market research, partnerships, targeted marketing, and robust customer support to ensure successful market entry and adoption.

Key Citations

- Traffic Management Market Size & Revenue Forecast, Global Trends, Growth Opportunities | MarketsandMarkets™

- Traffic Management Market Size, Share, Trend Analysis by 2033

- Traffic Management Market Size, Share, Trends Report, 2030

- Global Traffic Management Market Size Report, 2022 – 2030

- Intelligent Traffic Management System Market Report, 2030

- Traffic Management Market Report Size, Share and Trends 2030

- Traffic Management Market Size, Share, Growth | 2024 to 2029

- Traffic Management System Market Size, Share & Trend by 2033

- Traffic Management Market Size & Analysis | Forecast – 2032

- Radar technology in road traffic – RADAR-BLOG – Ein Technikjournal von InnoSenT

- Innovative radar solutions for reliable traffic detection

- Traffic Sensor | smartmicro®

- AGD

- Advancements in Radar and Air Traffic Control Systems – AVI-8 Timepieces

- Traffic Management Solutions | All Traffic Solutions

- EVO Radar – Sensors – Econolite

- New Radar Sensor Technology for Intelligent Multimodal Traffic Monitoring at Intersections | National Institute for Transportation and Communities

- How Radar Transforms Traffic Monitoring and Intersection Management

- Products – AGD

- Smart parking systems: comprehensive review based on various aspects – ScienceDirect

- Smart Parking | Types of smart parking systems — Cleverciti

- Smart Parking Availability and Guidance Solutions | All Traffic Solutions

- Car Parking Management System – FRESH Equipment

- Car Parking Management Solution

- CuroPark | Intellegent Parking Management System | ANPR Based Parking Management System in India | Vehicle Parking Management Software

- Radar sensors support parking management

- Parking Systems – FRESH Equipment Parking System

- Parking Management System | Scalable Software

- Parking Management – Products – Hikvision

- Millimeter wave Radar for Pedestrian Detection | Sumitomo Electric

- AGD

- Requirements on automotive radar systems for enhanced pedestrian protection – IEEE Conference Publication

- Pedestrian Detection Safety Feature: My Car Does What

- Enhancing Vehicle Safety: Radars and ADAS Systems | Controlar

- Radar-Based Pedestrian and Vehicle Detection and Identification for Driving Assistance

- Neighborhood Traffic Calming Solutions – Radarsign – Radar Speed Signs

- Street-based radar system designed to save pedestrian lives

- Why LiDAR Surpasses Cameras and Radar for ITS

- How Automotive Radars Are Advancing Safety Features

- Understanding ADAS: Pedestrian Alert Systems (PAS) – Car ADAS

- Requirements on automotive radar systems for enhanced pedestrian protection – IEEE Conference Publication

- Amazon.com: Car Reverse Parking Radar System with 8 Parking Sensors Distance Detection + LED Distance Display + Sound Warning (Black Color) : …

- Pedestrian Crosswalk Safety Solutions – Universal Signs & Accessories

- How to Keep Pedestrians Safe in the Parking Lot – Transline Industries

- Millimeter wave Radar for Pedestrian Detection | Sumitomo Electric

- Pedestrian Detection Safety Feature: My Car Does What

- Street-based radar system designed to save pedestrian lives

- Parallel Parking Under the Radar | WIRED

- Tips For Enhancing Parking Lot Pedestrian Safety – Traffic Safety Resource Center

- Parking Lots & Distracted Driving- National Safety Council

- How to Keep Pedestrians Safe in the Parking Lot – Transline Industries

- Staying Safe in a Parking Lot | OnStar Tips

- Parking Lot Safety – Montgomery County, Md

- Pedestrian and traffic safety in parking lots at SNL/NM : audit background report. (Technical Report) | OSTI.GOV

- Parking Lot Safety – PLH Group Inc

- Stay Safe with These Parking Lot Safety Tips – Florida Sheriffs Association

- Parking_Lot_Safety_Tips

- Stay Safe with These Parking Lot Safety Tips for Pedestrians and Drivers – Wawanesa U.S

Product Comparison – Traffic Radars – Pocket Radar Inc.

Laser and Radar Measurement Systems | MPH Industries

Air traffic radar, ATM radar – All the aeronautical manufacturers

Surveillance radar – All the aeronautical manufacturers

Pro Traffic Advisor (Model PR1000-TA) – Pocket Radar Inc.

Product Comparison – All Radars – Pocket Radar Inc.

These 7 Radar Detectors Are the Ticket to More Informed Driving

A Survey and Comparison of Low-Cost Sensing Technologies for Road Traffic Monitoring – PMC

Best Strategies for International Expansion

5 steps to build an international expansion strategy – Lokalise

Crafting a winning international business strategy

Top 5 Global Expansion Strategies for Growing Businesses

7 Factors to Consider for Global Business Expansion

Market Expansion Strategies | Safeguard Global

Why International Expansion Is a Huge Business Growth Hack

What is an international strategy & why do companies adopt it?

5 Challenges Of International Expansion And Best Solutions

What Is Global Expansion, and What Strategy to Use? | Phrase

Understanding ADAS: Pedestrian Alert Systems (PAS) – Car ADAS

Pedestrian Crosswalk Safety Solutions – Universal Signs & Accessories

How to Keep Pedestrians Safe in the Parking Lot – Transline Industries

Millimeter wave Radar f or Pedestrian Detection | Sumitomo Electric

Pedestrian Detection Safety Feature: My Car Does What

Street-based radar system designed to save pedestrian lives

Parallel Parking Under the Radar | WIRED

Smart parking systems: comprehensive review based on various aspects – ScienceDirect