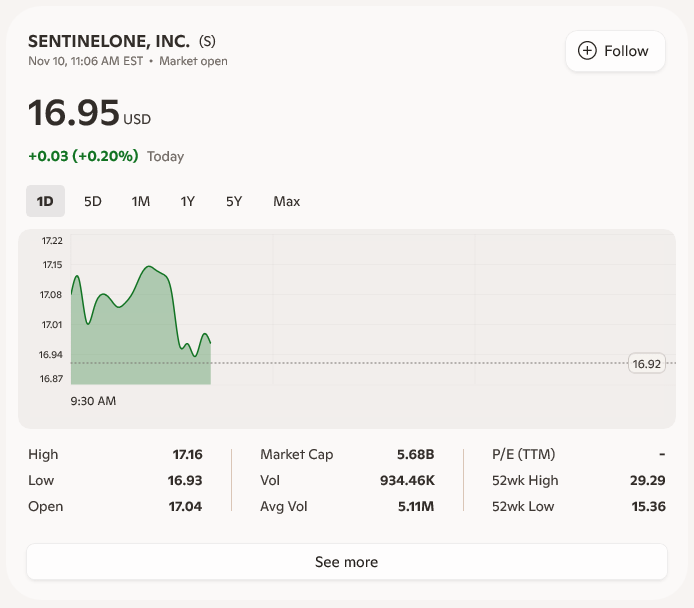

Nov 10, 1:56 PM EST • Market open

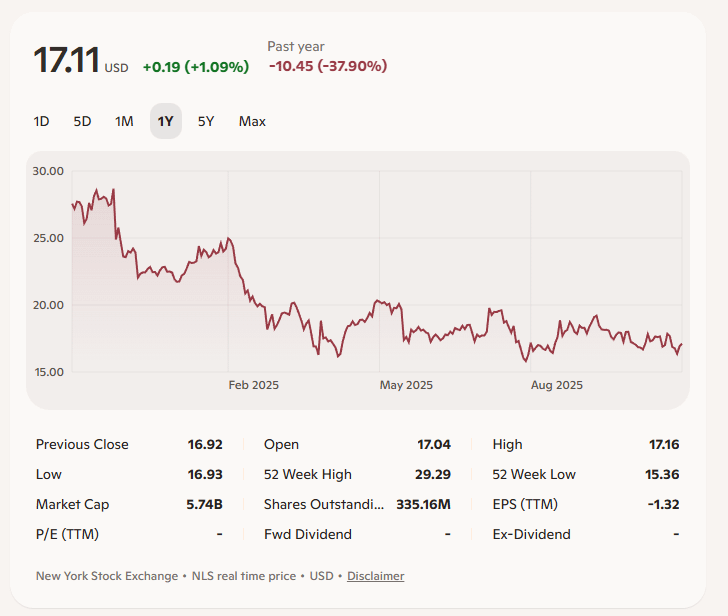

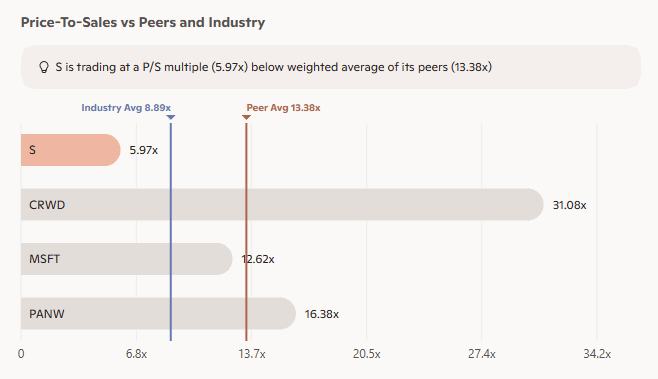

- Price performance: SentinelOne Inc (S) is trading at $17.12, up 1.18% during market hours, with a volume of 1.63M shares. The stock’s market cap stands at $5.74B, reflecting moderate investor activity today.

- Recent news developments: Broader tech market caution following AI-driven rallies has impacted high-growth stocks like SentinelOne, with concerns over stretched valuations and profit-taking dominating sentiment 1.

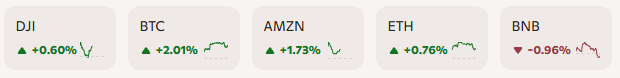

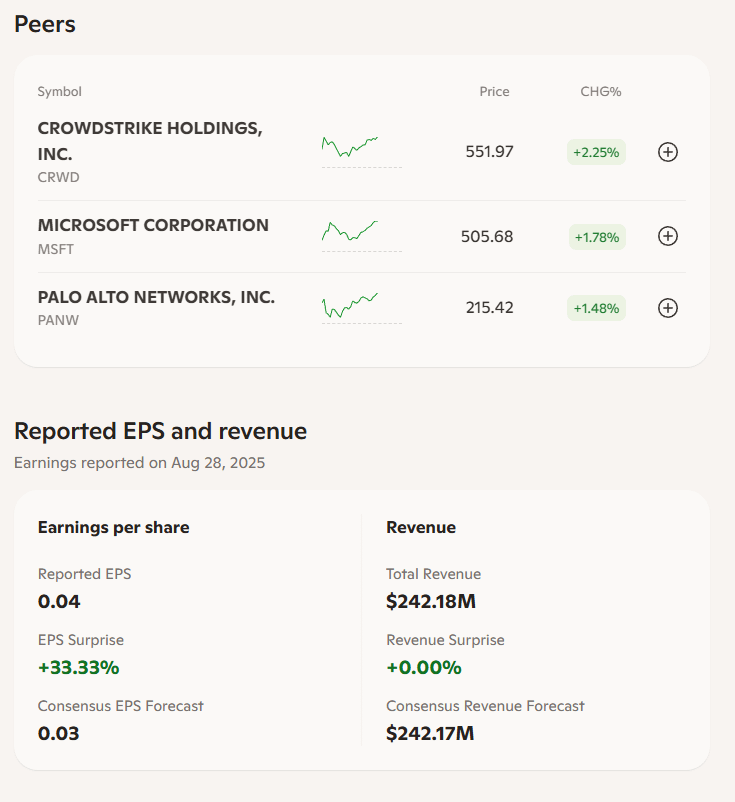

- Benchmark comparison: S outperformed the Dow Jones (+0.6%) but underperformed the S&P 500 (+1.39%) and NASDAQ Composite (+2.16%). Among peers, S underperformed CrowdStrike (+2.25%), Microsoft (+1.78%), and Palo Alto Networks (+1.48%).

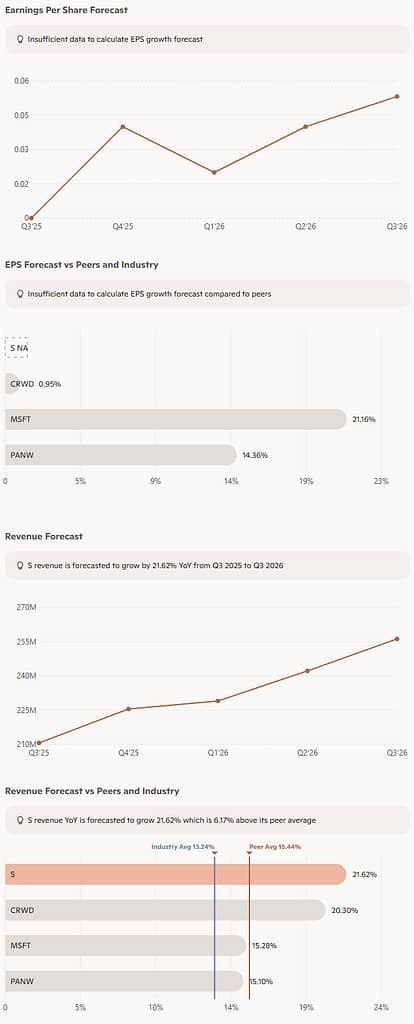

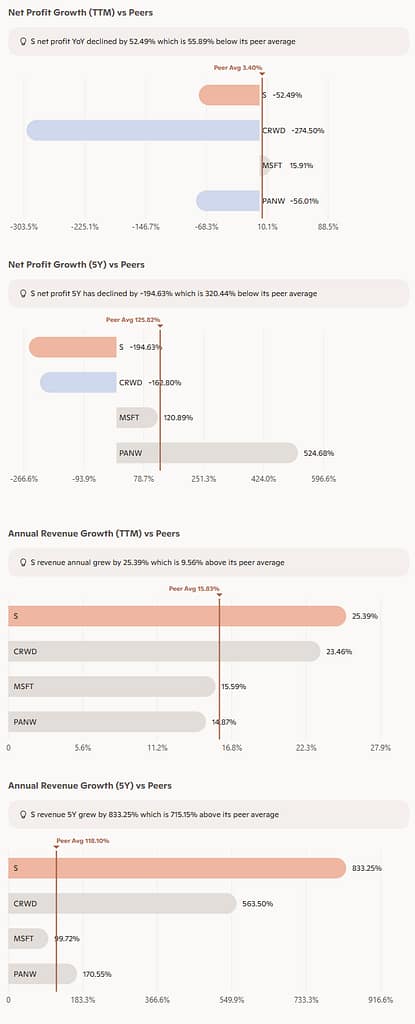

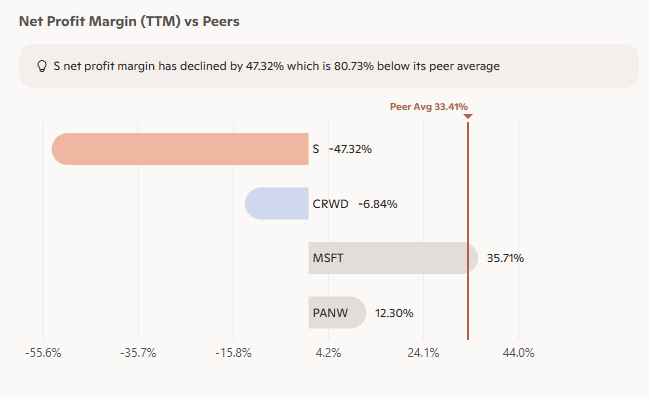

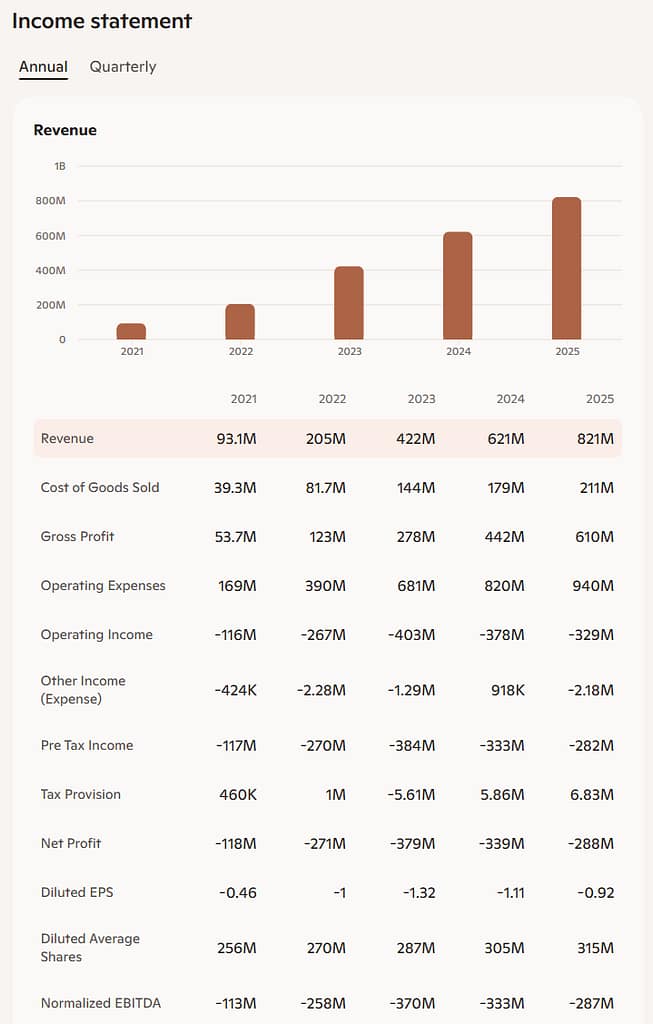

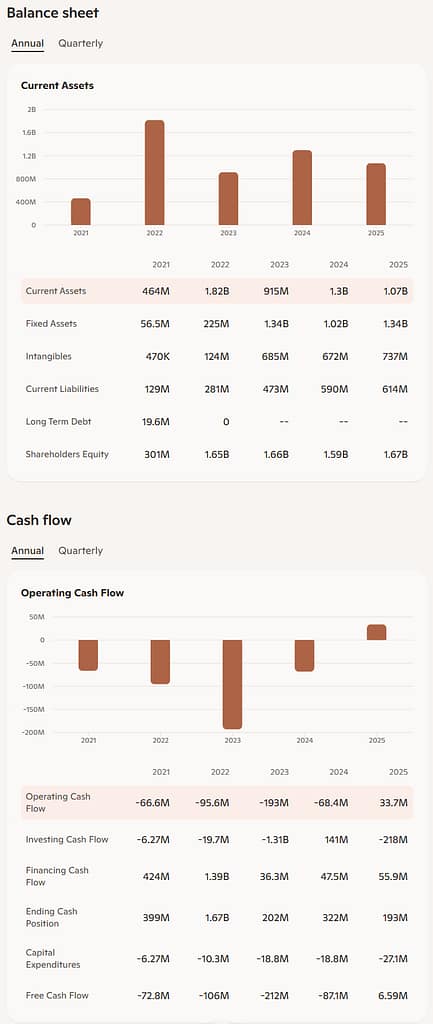

- Investor outlook: Analysts rate S as “Buy,” with a mean price target of $23.53, 37% above its current price. Revenue growth of 21.62% YoY is forecasted, exceeding industry averages. However, declining net profit margins and negative Return on Equity (-17.68%) may concern investors.

- Earnings results: SentinelOne reported Q2 FY 2026 EPS of $0.04, exceeding expectations of $0.03. Total revenue grew 22% year-over-year to $242 million, driven by a 24% increase in Annual Recurring Revenue (ARR) to over $1 billion. Gross margin remained strong at 79%, and operating margin improved by over 500 basis points to 2%.

- Company executive summary and Q&A: SentinelOne’s growth was fueled by new customer additions, expansion with existing accounts, and strong adoption of AI and data solutions. Key drivers included triple-digit growth in Purple AI and record contributions from data solutions. The newly launched SentinelOne Flex licensing model, which simplifies platform adoption, secured an 8-figure deal. Executives highlighted strong execution, platform differentiation, and a balanced contribution from both U.S. and international markets.

- Guidance and outlook: Full-year FY 2026 revenue guidance was raised to $998 million-$1.02 billion, reflecting 22% growth. Operating margin for the year is expected to improve by 600 basis points. The company remains cautious on macroeconomic variability and deal timing but anticipates sustained profitability and free cash flow growth.

- Strategic Updates: SentinelOne acquired Prompt Security for $180 million, entering the generative AI security space. This acquisition enhances its Singularity platform with tools to monitor and govern GenAI usage, addressing emerging enterprise risks. The company continues to expand partnerships, including deeper integration with AWS tools and recognition as a key vendor by Pax8.

https://www.marketbeat.com/earnings/reports/2025-8-28-sentinelone-inc-stock

https://www.insidermonkey.com/blog/sentinelone-inc-nyses-q2-2026-earnings-call-transcript-1599700

I’m demonstrating a new Markets feature of Copilot, making this a habit remains to be seen.